GROW YOUR BUSINESS

Noomerik [Official] Business Payment Processing powered by is a simple and powerful way to accept payments from cards and ACH. Explore payment links, customized invoices, subscription types and more.

Simple Pricing

You always know what you’ll pay, and there are no hidden fees or long-term contracts.

Easy to Use

With online account activation and no-code setup options, start accepting card payments quickly and seamlessly.

Reliable Integration

{{custom_values.provider_name}} is fully integrated into the {{location.name}} CRM system and is highly customizable or effective out of the box.

Customer Service

We’re committed to helping you every step of the way with reachable support and onboarding resources.

Fight Fraud

We use hundreds of billions of data points and powerful algorithms to keep you and your customers safe.

Customer Flexibility

Give your customers multiple payment options using all major credit and debit cards or bank to bank transfers with ACH.

GROW YOUR BUSINESS

Noomerik [Official] Business Payment Processing powered by is a simple and powerful way to accept payments from cards and ACH. Explore payment links, customized invoices, subscription types and more.

Simple Pricing

You always know what you’ll pay, and there are no hidden fees or long-term contracts.

Easy to Use

With online account opening and no-code setup options, start accepting card payments quickly and seamlessly.

Reliable Integration

Stripe is certified to the highest compliance standards, and its highly scalable systems operate with 99.99%+ uptime.

Customer Service

We’re committed to helping you every step of the way with always on support and onboarding resources.

Fight Fraud

We use hundreds of billions of data points and powerful algorithms to keep you and your customers safe.

Customer Flexibility

Give your customers payment options across 135+ currencies using all major credit and debit cards or popular wallet payment methods.

Here’s what it means for you.

Here’s what it means for you.

Payment Links

Share a reusable link via email, your website or social channels for your customers to pay for your product or service. Payment links can be a safe alternative to a Virtual Terminal.

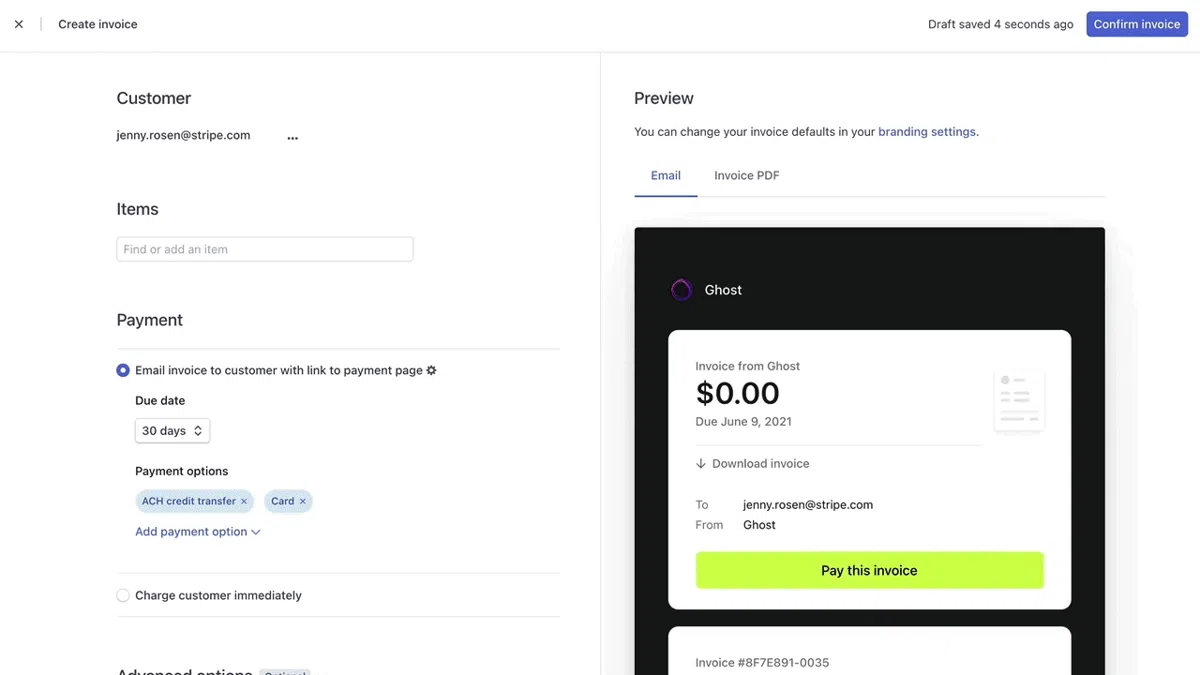

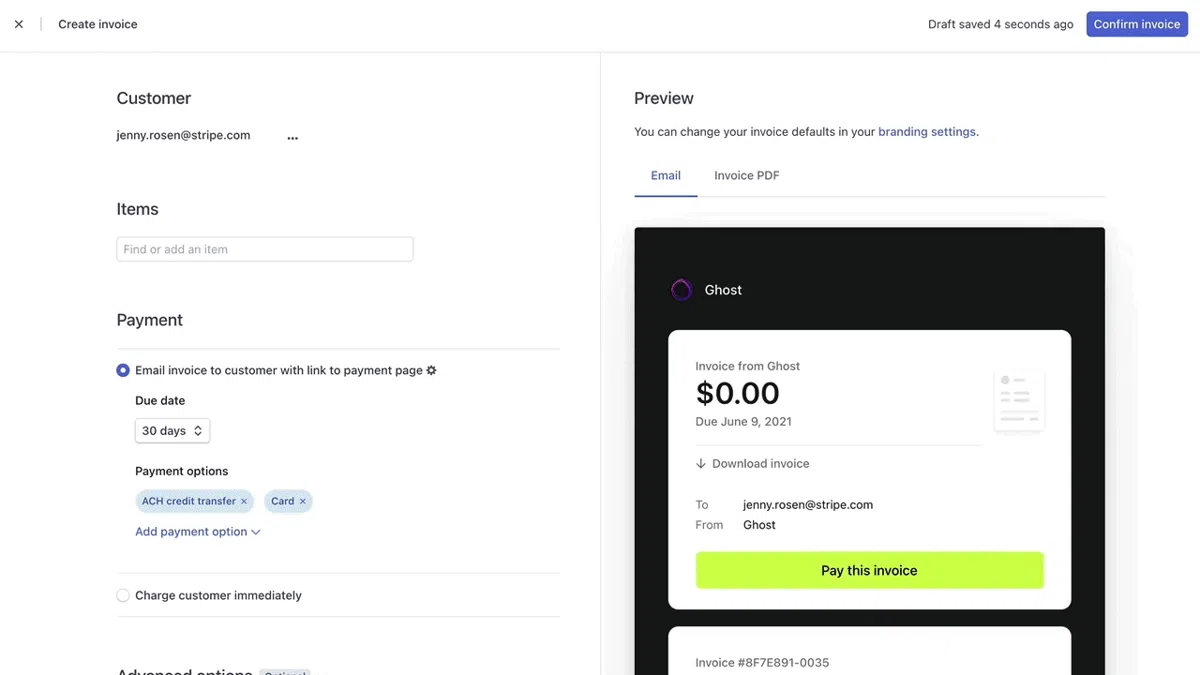

Invoices

Send an invoice to each customer customized with your brand, products or services and pricing. You can even make them recurring.

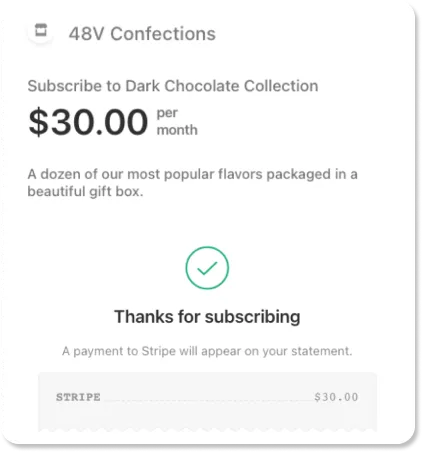

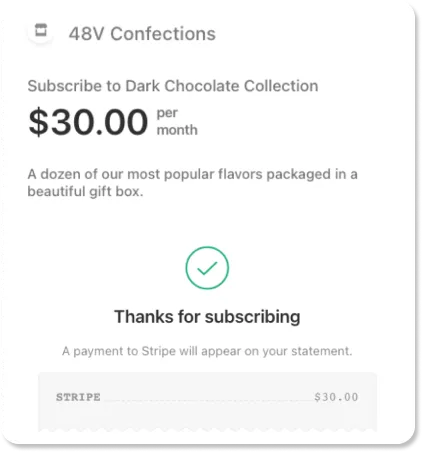

Subscriptions

Automate recurring payments with our included subscriptions tool.

Payment Links

Share a reusable link via email, your website or social channels for your customers to pay for your product or service. Payment links can be a safe alternative to a Virtual Terminal.

Invoices

Send an invoice to each customer customized with your brand, products or services and pricing.

Subscriptions

Automate recurring payments with our premium add-on subscriptions tool.

OUR RATES

Access a complete payments platform with simple pricing

FEES CHARGED

Processing fee:

0% + $0.15 per successful card charge

1% per ACH direct debit + $0.30 per successful transaction

Invoicing fee:

$0.25 per invoice on top of processing fees

Subscription:

No additional fees

Monthly fee:

$79, which includes your merchant accounts, gateway and software

OUR RATES

Access a complete payments platform with simple, pay-as-you-go pricing

FEES CHARGED

Processing fee:

2.9% + $0.30 per successful card charge

0.8% per ACH direct debit, capped at $5.00

Invoicing fee:

No additional fee for first 25 paid invoices per month;

0.4% thereafter per paid invoice on top of processing fees

Subscription:

0.5% on top of processing fees

No setup fees

No monthly or annual fees

No contract

FREQUENTLY ASKED QUESTIONS

( Some responses may prompt you to leave the Noomerik [Official] website and visit for more information. Please review their privacyand security policies, which may differ from ours. )

What is ?

offers payment processing, which enables your customers to make payments using a variety of methods such as credit cards, debit cards and ACH transfers. With , you'll have a cost effective, simple tool to accept payments online or in-person without long-term contracts or costly fees.

Who is for? Who cannot use ?

is currently offered to businesses with at least $5,000 in monthly revenue who want to keep their payment processing costs low and who need a scalable processing partner.

To use and transact on , and it's banking partners must verify your:

1-Business identification (address and website ownership) and bank account information

2-Supportability of your business: what you sell, and if can support your product/category

3-The overall risk level of your business

To learn more about the categories of businesses and business practices that are restricted from using , please visit here.

What types of payments can I accept?

allows you to accept a wide variety of payment types. Noomerik [Official] Business Payment Processing powered by supports payment types such as:

1-Credit and debit cards, including large global networks such as Visa, Mastercard, American Express, Discover & Diners

2-Bank transfers such as ACH or other debits from international institutions

Is reliable and secure?

Yes, 's systems process 24 trillion transactions annually with over $185 billion in volume, are highly scalable and redundant. and it's banking and gateway partners also meets and exceeds the most stringent industry standards for security, with certification to PCI Service Provider Level 1.

Will I be PCI-compliant?

is audited by a PCI-certified auditor, and is certified to PCI Service Provider Level 1. This is the highest of the four PCI compliance levels.

When will I receive funds in my bank account from my transactions?

You will typically receive your payouts 2 business days from settlement and ask the account matures you can have the option of next day deposit without any additional cost.

How do I sign up for Noomerik [Official] Business Payment Processing powered by ? What is the process and how long will it take?

To start the sign-up process, click on "Enroll Now" on the top of this page. After the redirection to , complete the guided application and start your approval process in minutes. In most applications, the account approval process takes 3-5 business days and you will receive an email from notifying you that you can accept payments when approved. If needs more information about your business or expects a longer delay in approving your account, they will reach out to you. Businesses taking longer to verify identity or submit supporting documentation commonly experience longer processing delays.

What information and documents do I need to sign up for Noomerik [Official] Business Payment Processing powered by ?

To start the application process, you'll need an email address. To approve your account, will need details about your business and about you. Common follow-up requirements include photo identification documents, address verification, bank statements, EIN or SSN, marketing materials, price lists and contracts and agreements if you have a recurring product. You can find a full list of requirements here. Tip: Make sure you've added the website associated with the goods and services you're using for (if applicable).

What do I do if I have issues signing up?

Depending on the issue you're facing, here are some resolution options:

1-If you are experiencing issues accessing the application link that Noomerik [Official] provided, please contact them for assistance

2-If the Noomerik [Official] or website is experiencing technical issues, please try refreshing the page and re-enrolling

3-If you're not able to submit the application, please email

Who should I contact if I have questions about this invitation to join Noomerik [Official] Business Payment Processing powered by ?

If you have discussed this invitation with Noomerik [Official] please contact them with questions. For all other questions, please contact

How would my data be treated between Noomerik [Official] and ?

Noomerik [Official] is a "CRM Platform" that uses , which provides payment processing software. When you sign up for an account with Noomerik [Official] Payment Processing powered by , you agree that may share data about you or your account activity with it's processing and gateway partners to facilitate your use of the account. Noomerik [Official] may use that data to send important information about your account.

Can I see an estimate of my monthly costs with ?

Yes, you can estimate your monthly costs by going here and putting in your monthly volume and average sales amount.

* is currently offered to businesses doing at least $5,000 a month in sales volume.

Getting started with our partner merchant services provider means leaving the Noomerik [Official] website to visit . Please review their privacy and security policies, which may differ from ours.